Today, Exeter City Supporters’ Trust members received an email communication about two issues pertaining to a proposed redevelopment of the accommodation at the Clifford Hill Training Ground, and subsequent vote of the membership.

Here is the full communication:

Dear Member,

In accordance with rule 46 of our constitution this letter provides 14 days’ notice to you of a member’s postal ballot.

A copy of the constitution can be found here. The ballot will be conducted by electronic voting where possible. If no email address is held for a qualifying member a postal ballot will be provided, along with this documentation.

We will be asking you to vote on two issues pertaining to a proposed redevelopment of the accommodation at the Clifford Hill Training Ground.

Under the terms of the Club/Trust Agreement (the CTA), a copy of which can be found here, the club are required to obtain Trust consent prior to entering contracts above the value of £50k. The value of this particular contract is £2.2m and therefore falls within this requirement. Given the exceptional amount the Trust Board, whilst supporting this proposal, feel it appropriate to seek member approval.

In addition to this, the club have also requested that we, the Trust, make available to the club a loan of up to £600k and so again, we seek our members approval to do so.

Four suppliers were invited to tender for the works and three responded. The preferred supplier is Enviro Building Solutions Limited (Modular Building Manufacturer | Enviro Building Solutions Ltd).

The full proposals plus supporting information, plus construction plans, are included in this document. Further, we would invite you to a Trust forum, to be held at the Phoenix Centre, commencing 11am on 23rd October, to make any comments or ask questions. If you are unable to attend or would prefer earlier contact, please e-mail: chtg@ecfcst.org.uk (We’ll get back to you as quickly as we are able.)

The two proposals will be as follows:

- Under the terms of the Club Trust Agreement (2,vii) Exeter City AFC Limited will enter into a contract for the redevelopment of the Clifford Hill Training Ground accommodation with Enviro Building Solutions Limited, as detailed in the documentation made available to me.

- That the Exeter City AFC Supporters Society Limited, make available to Exeter City AFC Limited, a loan up to the value of £600k. Such a loan, if requested, would be repayable over 4 years in quarterly instalments and, at the Trust discretion, interest may be charge on this loan at a rate based on the consumer price index +1%.

The outcome of this ballot will be determined by a simple majority of 50% +1 of the votes cast and the result announced at 4pm on October 28, 2021 at St James Park.

Kindest regards

Nick Hawker, Trust Board Chair

Investment Proposal for the Cliff Hill Training Ground

Summary

After many years of planning the Club now finds itself in a positive financial situation which allows it to propose a significant £2.2m investment in the training facilities at Cliff Hill. Considering a sensible view of the Club’s cash position, the Club board forecasts sufficient cash to undertake the investment except for a short period in the summer of 2022 when development cash is at its highest and ahead of a £1m+ tranche of fees from recent player transfers due in September. This paper outlines the case for the investment, the approach taken to forecasting and sensitising this forecast, and requests Trust members approval to proceed with the project (subject to subsequent external financial due diligence), along with approval for a potential loan from the Trust to the Club of up to £600k for a period and under terms to be determined.

Background

For many years, the ability of the Club to develop, recruit and retain talent, in particular the development of young players through the Academy to the first team, has been key to the success of the Club both on the pitch and as a source of significant value creation through transfer fees. These fees have been vital to off-setting operational losses.

The Club and Trust boards have long held the ambition to improve the buildings and facilities at Cliff Hill, comprising an old sports pavilion building and extensive use of portacabins, recognising that these are significantly below what would be expected of a club of Exeter’s stature and that present severe compromises to those players and staff that use them.

Recent improvements in the Club’s finances, most significantly as a result of the sale (and his subsequent onward sale) of Ollie Watkins, present an opportunity to review these long-standing plans and to bring this proposal to Trust members for approval.

Rationale

The Club board considers that investment in Cliff Hill is required to protect the Club’s most valuable asset, the Academy pathway, to enhance the Club’s attractiveness to prospective players, and to assist in supporting and retaining all players through the provision of facilities befitting a club with League One ambitions.

Notwithstanding the agreed strategy to develop new sources of commercial income and to grow attendances, failing to invest in the training facilities will, in the board’s opinion, threaten our development pipeline, our footballing position, and ultimately threaten our transfer fee income with negative impact on the Club’s finances over time.

Investing in this proposal will additionally present strong evidence of the Club’s ambition and a compelling opportunity to engage sponsors and supporters to the overall benefit of the Club.

Proposal

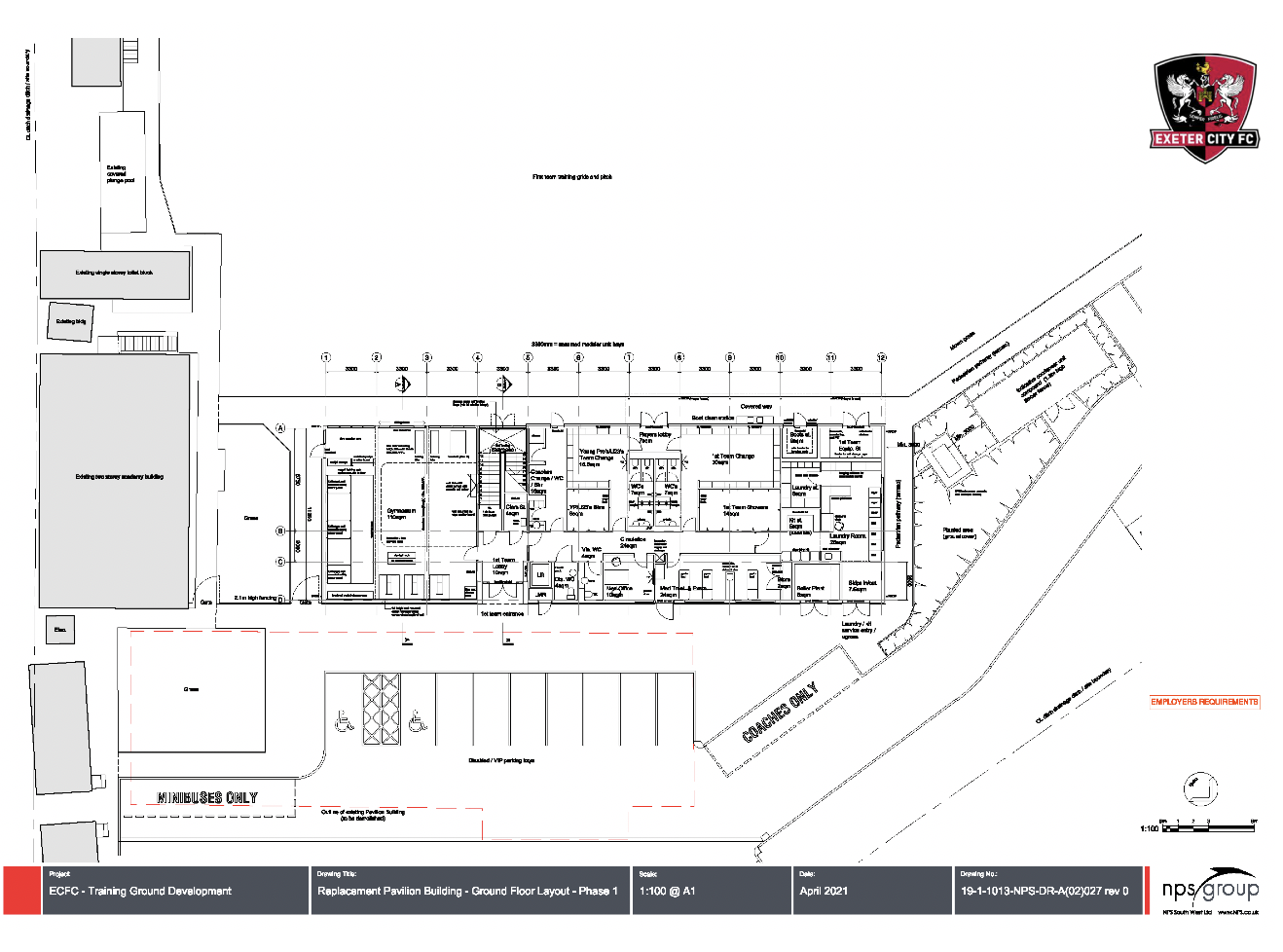

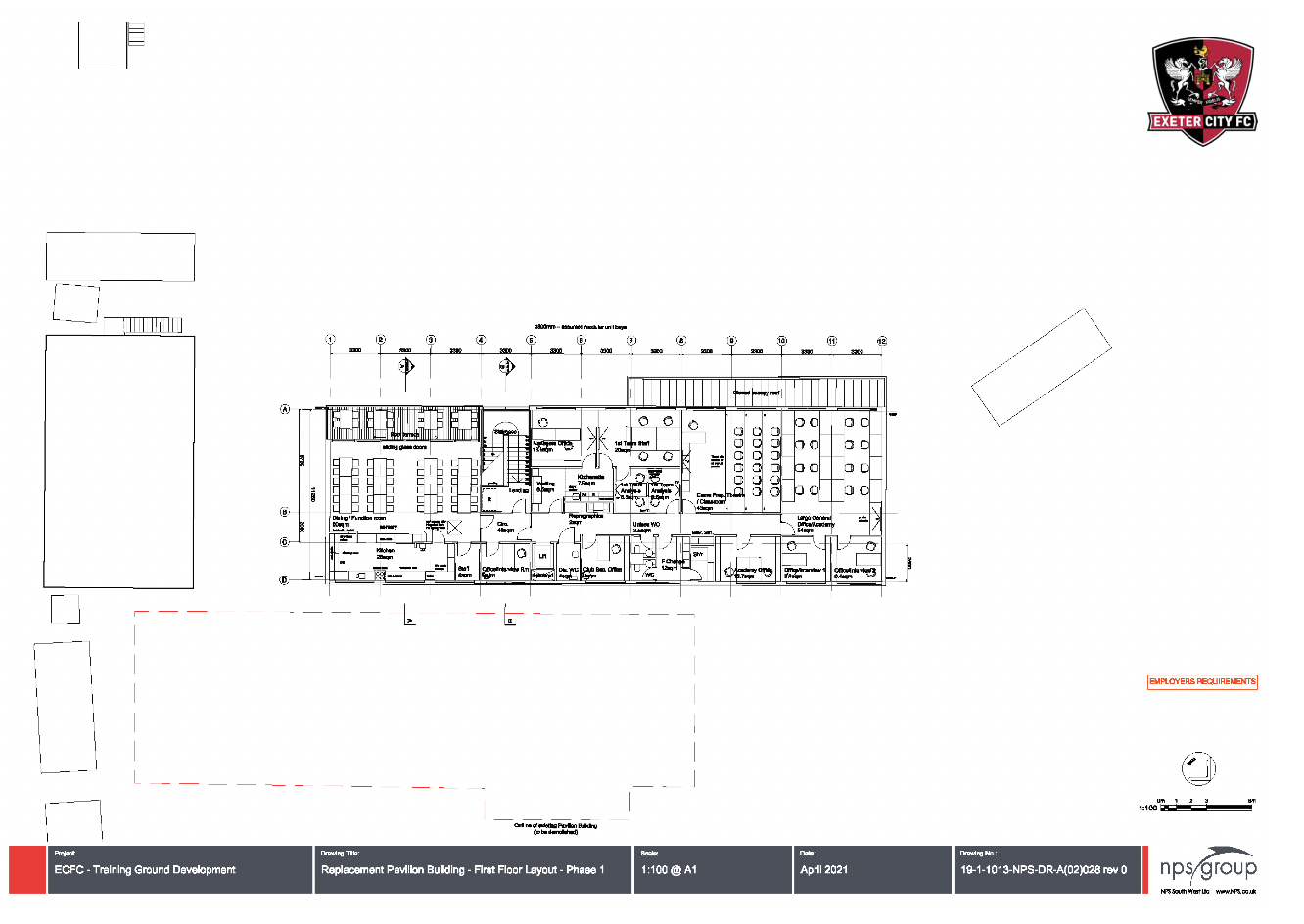

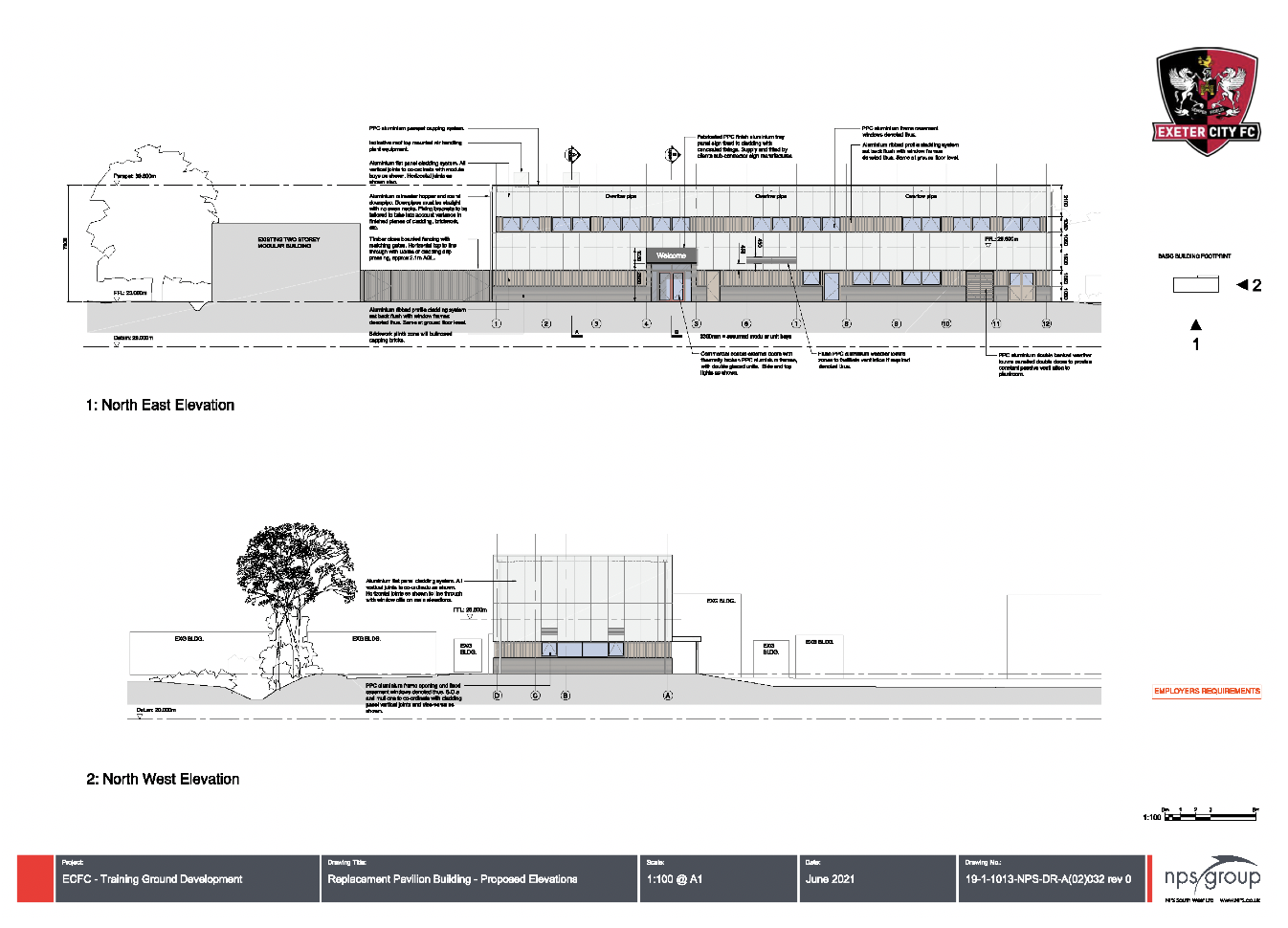

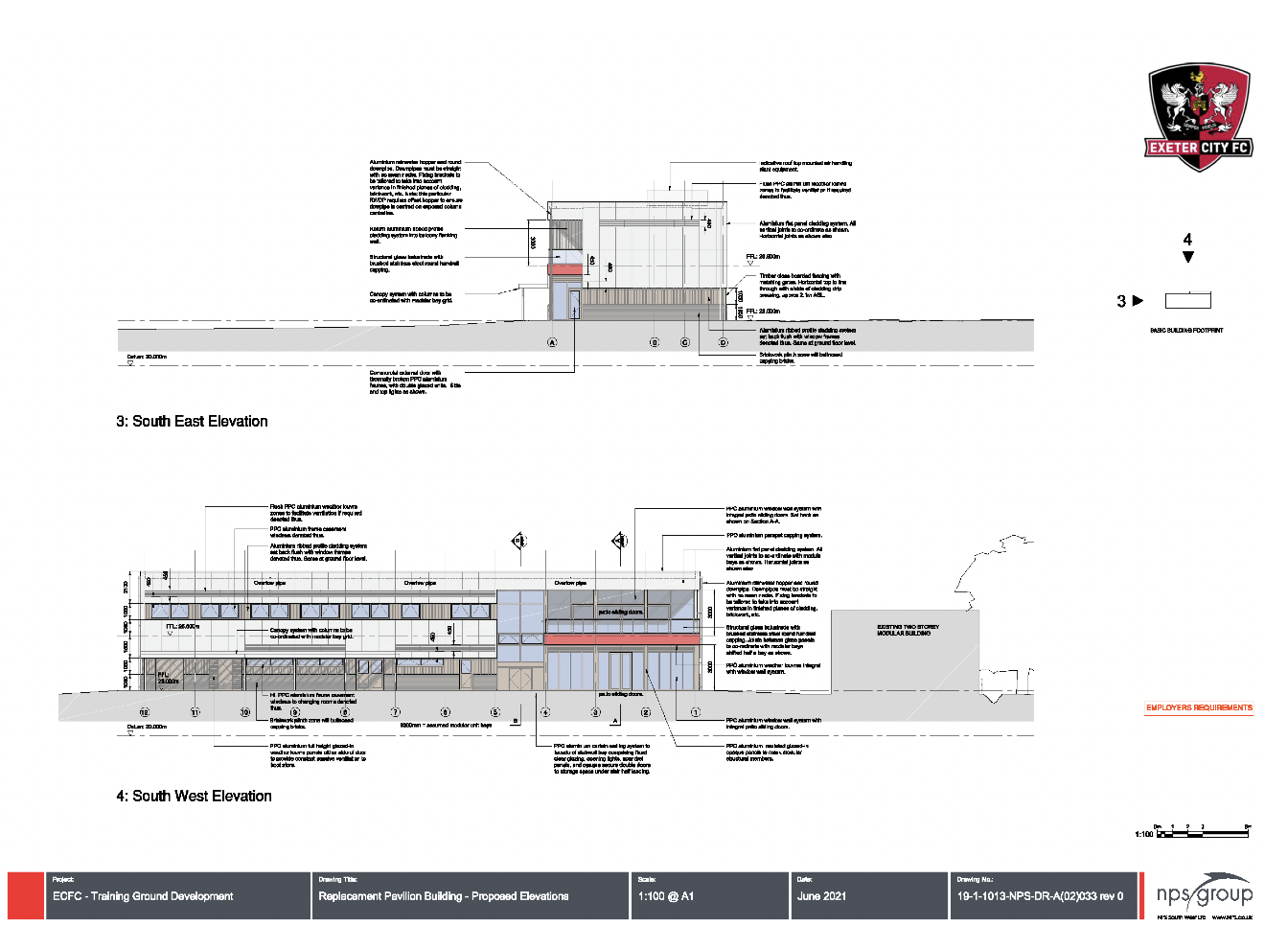

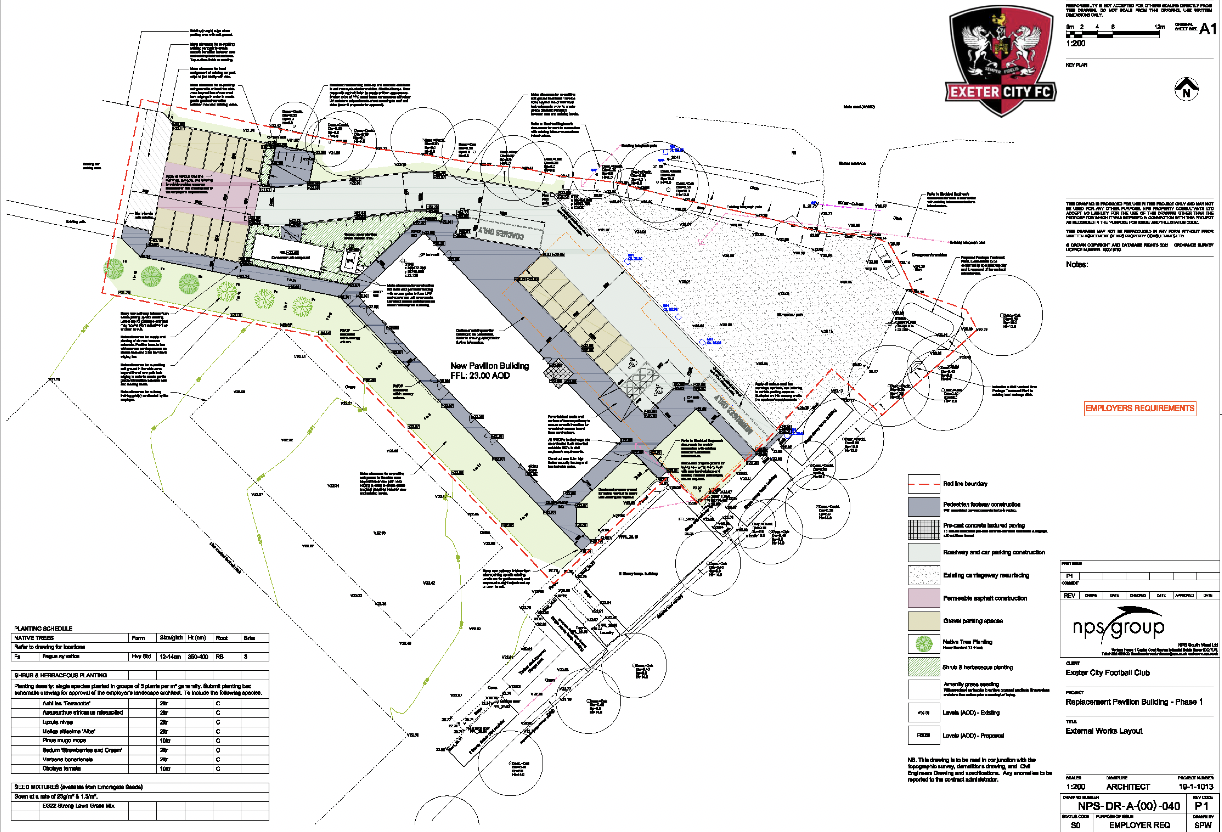

The proposed development provides for a completely new two-floor facility for both the First Team and Academy staff and players.

This building will include a new and larger gym, proper canteen facilities (no longer shared with gym), larger changing facilities, proper office accommodation and a theatre/analysis/classroom.

The cost of this investment is £2.2m. The Club board will seek to approve the programme and sign contracts by the end of October 2021, subject to:

- Trust member approval;

- financial due diligence from an external accountancy firm; and

- an appropriate long term lease agreement for the Clifford Hill Training Ground.

The estimated completion date and handover to the Club is September 2022. The state of the contractor market, coupled with the increasing market cost of materials suggests that a deferral of the project at this time would likely result in a significant (+25%+) increase in project price which could make the project unaffordable for the Club in the future. The First Team Manager is fully supportive of the investment and has confirmed his ability to continue with ‘business as usual’ during the build programme and to make any accommodation necessary to ensure the project’s success.

Affordability and risk

Considering this investment, the Club board have looked in detail at several scenarios. The main financial assessment, presented in the attached cash-flow documents, assumes a continuation in League Two as a base for planning. Achieving League One would come with an increase in costs, in particular the playing budget, but would also present uplifts in income from the EFL as well as obvious commercial opportunities too. Overall, the view is that these elements can be balanced and therefore that the base assumptions used here still apply. Relegation would of course present a more severe risk, and whilst considered unlikely in the near-term, cannot be ruled out. However, although manageable in the short- term, anything other than a short period in the National League would in any case require a fundamental review of costs and income whether this investment was made or not.

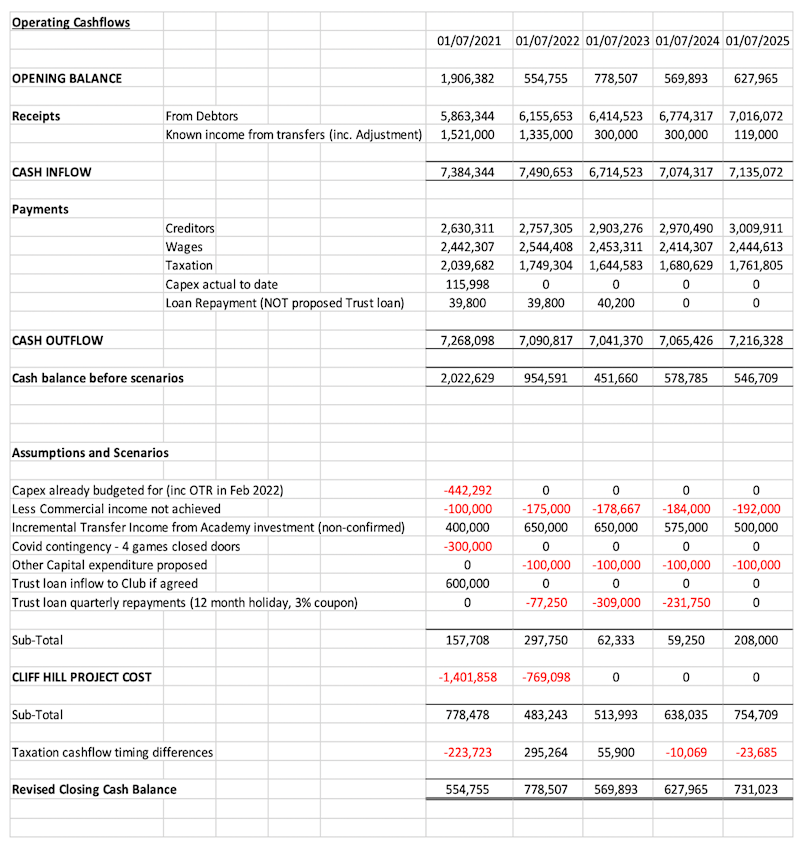

Attached to this proposal is a summary cash-flow over this financial year and the next 4 years. The 1st July 2022 is typically the cash low point in the year.

The assessment of affordability and risk is detailed here:

- We started with the base budget for 21/22 as approved by the Club board. To this we have used the actual numbers through to end September 2021 and have then applied some revised assumptions appropriate to the climate we find ourselves in – including higher input costs and higher inflation. Sensible assumptions on costs, wages etc have then been applied to future years to provide a base for the later four years of our forecast.

- Approved investment in our support team has been added to this base. This provides for increased resource in our Commercial, Marketing and Stadium operations, aimed at enhancing supporter experience and providing the resource to execute our ambitious plans to increase our club income through improving the supporter experience, growing attendances, and increasing commercial income. Whilst we have confidence in delivering to these plans, we have discounted all this benefit for the purpose of sensitising this investment proposal, including removing £100k in commercial income from the forecast for the balance of this season. We consider this very cautious as we would of course anticipate significantly growing income with the benefit of this additional resource.

- In terms of transfer fees and ‘add-ons’, our base forecast includes all confirmed income, including the last tranche of the fee for Ollie Watkins (due in August 2022) and the staged payments for Joel Randall. To this we have added our prudent assessment of the likely level of future (unconfirmed) fees. The forecast fees for the next four transfer windows total just over £1m, significantly less than the amount anticipated by the First Team Manager.

- Covid-19 remains a key issue. We have applied an assumption of a Covid “fire-break” at some point during this season, with a consequent reduction in cash of £300k due to fixture disruption. Additionally, we have an outstanding claim for business interruption insurance due to Covid-19. This claim is a significant six-figure sum. Given market-wide issues with Covid insurance claims, we have assumed no benefit in our forecast. However, it could be a very significant amount and be forthcoming in the near future.

- We have assumed that there will be a requirement for ongoing capital investment to maintain the fabric of the Club. We have allocated £100k per annum to this starting in 22/23.

Taking the above into consideration we forecast a marginally negative cash balance, post-investment at our cash low point of July 2022, this cash balance rising quickly in August 2022 with the final tranche of Ollie Watkins fee. The cash requirement for the investment project is £1.4m by July 2022, rising to £2.2m by September 2022.

Trust request

As a consequence of the above cash low point, the Club could find itself below the threshold of £600k agreed by the Trust as the minimum desirable to protect the Club in the normal course of business.

Given the sensitivities applied to the near-term forecast (a total of £400k in total due to Covid-19 and commercial income de-risk) it is possible that the cash balance will be near satisfactory at the July low-point. Nevertheless, the Trust board considers that, in addition to requesting approval of the Cliff Hill investment project, it is prudent to request that members approve the potential loan of up to £600k on commercial terms for a period to be determined closer to the time. For context, the Club repaid a loan to the Trust of £830k in the last financial year.

Next steps

Following agreement from the Trust Board, the Club board will commission an external accountancy firm to apply due diligence to the financial proposal. Subject to a satisfactory review the Club board will then meet to commit to the project and sign contracts for this by the end of October 2021.

Summary of key financial risks at 10th October 2021

Any decision concerning the future involves risk – no-one knows the future after all. We therefore need a strong business case, a strong financial analysis, and sensitivity analysis of the judgements made before a decision is made.

What makes this decision a significant risk to all of us is its sheer scale.

The focus here is our financial case, and the evidence and robustness of the numbers. This is made more difficult notably because:

- The Club’s vision is to be a League one, sustainable club. But we always have to guard against complacency and the threat of relegation (and its massive impact on our finances) and this means our judgement has to be underpinned by robust, strong evidence.

- The Club is owned and funded by its fans – and we ask a lot of you already in terms of support and finance. No-one wants to go back to emergency, crisis days of old.

- With a capital appraisal of this nature, and a number of assumptions, there is additional need to understand our taxation inflows and outflows. This is a complex topic; we are asking a lot of our team to have this scenario modelling in place in such a short period of time and at this point this is one of the key risk areas in the model which needs further diligence (see below).

- Lastly, our finance function is, right now, short of resource. We are putting a huge amount of pressure on our finance staff to prepare the costings required in a difficult, stressful time for them, completing a year-end process and also managing the ‘day job’. This isn’t fair, nor is it without risk since we are asking them to react quickly, in an area we don’t typically work in (capital investment) and under great pressure if they get their assumptions or numbers wrong.

What Does this Mean?

The Club Board wishes to proceed to consider this opportunity before the end of October to make a positive decision on the investment – in other words, to proceed or not. This is why the business case paper asks for conditional approval from the Trust to approve a loan matters noted above.

We believe we are at a stage in the project where the outline cases, numbers and assumptions lead us to conclude reasonably that the project is possible. But in the case of the financials, we MUST ensure that the case is robust and moves from possible to probable/achievable. Hence our view is that the Club Board should commission a third-party firm of financial experts to conduct a short diligence exercise. The aim being to give assurance and insight into the modelling work done to date, and ensure it is robust and accurate.

To that end, we set out below the steps I believe the Trust board should consider and support to ensure that we can all make a rational, considered judgment by the end of October.

Proposed process from here

The Trust Board have formed an independent view on the proposal. Its merits, its risks and whether to back a Club Board decision (if taken) that the investment in Cliff Hill is the best use of shareholder funds.

In a typical investment project involving outside funders (i.e., a bank or investment fund), the process would typically be:

- Management prepares a plan and detailed costings

- Present this to the Funder

- The Funder agrees to proceed in principle – and asks for a short period of further diligence (generally financial due diligence) from a third party to ensure the numbers ‘add up’

- This is done quickly, does not commit the funder to ‘do the deal’ and if the diligence backs the management plan and its reliability an offer is made by the funder with terms attached

- Crucially too, if the diligence is negative, management are able to either revise their projections to ensure they are achievable or reject proceeding with the project in light of the new evidence.

This, we suggest, is a process that we should follow in this instance. It is also a rational model to mitigate much of our risk at this point in the project.

Here is a cash-flow statement to further support this proposal:

Annual Cash Flow Forecast (2021 – 2025)

Note: OTR is reference to the purchase of the building at St James Park that accommodates club offices, supporter bars and hospitality lounges (e.g., Trust Suite, RGB Sponsors Lounge and the ECFC Museum).

Finally, we provide floor plans and external elevations with regard to the proposed construction.